News And PoliticsCommunications And EntertainmentSports And FitnessHealth And LifestyleOthersGeneralWorldnewsBusiness And MoneyNigerianewsRelationship And MarriageStories And PoemsArts And EducationScience And TechnologyCelebrityEntertainmentMotivationalsReligion And PrinciplesNewsFood And KitchenHealthPersonal Care And BeautyBusinessFamily And HolidaysStoriesIT And Computer ScienceSportsRelationshipsLawLifestyleComedyReligionLifetipsEducationMotivationAgriculturePoliticsAnnouncementUSMLE And MedicalsMoneyEngineeringPoemsSocial SciencesHistoryFoodGive AidBeautyMarriageQuestions And AnswersHobbies And HandiworksVehicles And MobilityTechnologyFamilyPrinciplesNatureQuotesFashionAdvertisementChildrenKitchenGive HelpArtsWomenSpiritualityQuestions AnsweredAnimalsHerbal MedicineSciencePersonal CareFitnessTravelSecurityOpinionMedicineHome RemedyMenReviewsHobbiesGiveawayHolidaysUsmleVehiclesHandiworksHalloweenQ&A

Top Recent

Loading...

profile/8302images3.jpeg.webp

Gistlegit

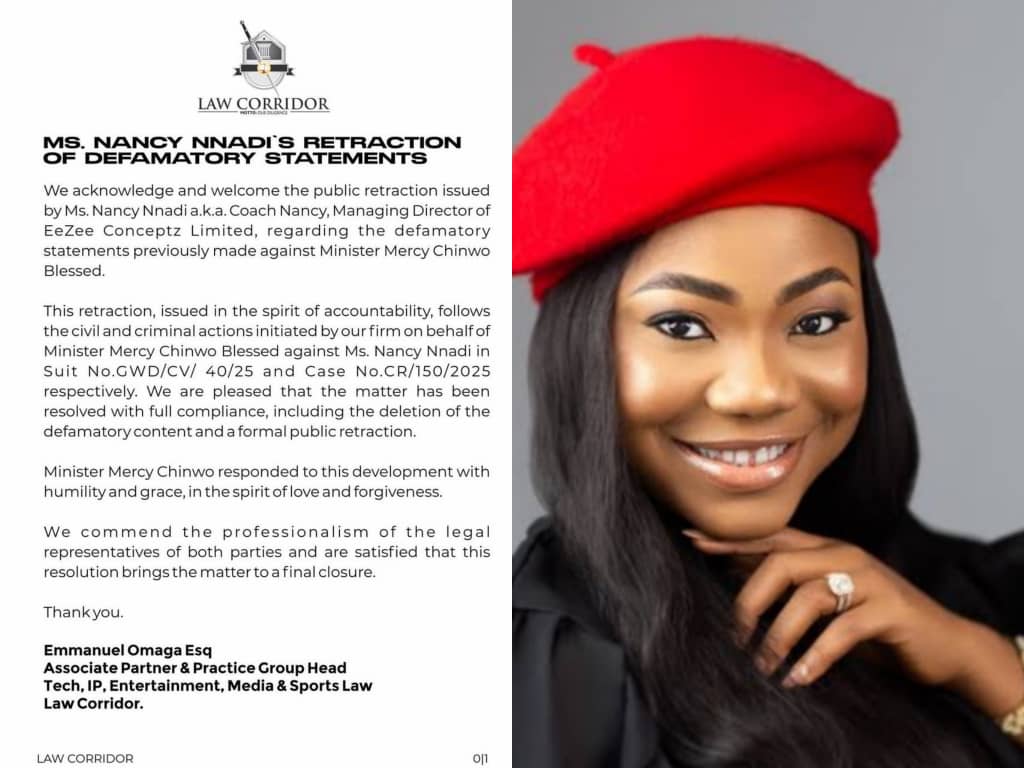

MD Of EeZee Conceptz Retracts Allegations Against Mercy Chinwo In Public Apology

~120.9 mins read

MD of EeZee Conceptz Retracts Allegation Against Mercy Chinwo

LAGOS — In a significant development that marks the resolution of a highly publicized controversy, Coach Nancy Nnadi, the Managing Director of EeZee Conceptz Limited, has publicly retracted her earlier defamatory statements against award-winning gospel music minister, Mercy Chinwo Blessed.

The retraction was made public on Sunday via Coach Nancy’s official Instagram page, where she acknowledged her prior missteps and expressed a desire for peace and spiritual reconciliation.

“On the advice of my lawyer, and for the sake of peace and love of God, I retract my earlier post about Minister Mercy Chinwo as well as pray Almighty God to perfect the ongoing settlement by THE FATHERS OF FAITH between her and EeZee Conceptz,” she stated.

The retraction comes months after Mercy Chinwo, through her legal counsel at Law Corridor, led by Managing Partner Pelumi Olajengbesi, filed a defamation suit at the High Court of the Federal Capital Territory, Abuja. The lawsuit accused Coach Nancy of spreading false and damaging allegations on social media, including claims that Chinwo had diverted funds in connection with an ongoing contractual dispute involving EeZee Conceptz and its founder, Ezekiel Onyedikachukwu (popularly known as EeZee Tee).

The legal action sought a public apology, deletion of the defamatory content, and compensation for the reputational damage caused. In response, Mercy Chinwo’s legal team presented verified documentation—including contracts, email correspondence, and payment receipts—that firmly refuted the claims and upheld her integrity.

Following these developments, Coach Nancy’s legal representatives initiated settlement discussions. A formal agreement was reached, which included the immediate removal of the defamatory video posted on February 4, 2025, a public retraction, and a commitment to refrain from making any further disparaging remarks.

All terms of the settlement have now been fully complied with by Coach Nancy.

In an official response, Mercy Chinwo’s legal team commended her for handling the issue with “grace, professionalism, and spiritual maturity.” The statement also highlighted that this outcome not only vindicates Mercy Chinwo’s name but reaffirms her character as a minister who chose truth over noise, and justice over vengeance.

The resolution was facilitated by the intervention of respected Fathers of Faith, whose leadership and spiritual guidance helped steer the situation toward peaceful settlement.

This outcome is not just a legal victory, but a testament to the power of accountability, humility, and the unifying role of faith within the gospel community. Mercy Chinwo continues to maintain her reputation as one of Africa’s most respected gospel voices, committed to integrity both in music and ministry.

profile/5683FB_IMG_16533107021641748.jpg

News_Naija

Anglique Kidjo Makes History With Hollywood Walk Of Fame Star

~1.6 mins read

Beninese music icon and five-time Grammy winner, Angélique Kidjo, has made history as the first African artiste ever selected for a star on the Hollywood Walk of Fame. The announcement was made on Wednesday, during a conference by the Hollywood Chamber of Commerce in Los Angeles, unveiling the Class of 2026 honourees. Kidjo, whose four-decade music career spans Afrobeat, jazz, funk, and traditional West African sounds, was named alongside 34 global entertainment figures including Miley Cyrus, Timothée Chalamet, Shaquille O’Neal, Deepika Padukone, and Lea Salonga. Her selection is part of a list ratified by the Hollywood Walk of Fame board of directors on June 25, after reviewing hundreds of global nominations. Recipients are expected to schedule their star ceremony within two years. Born in Cotonou, Benin, in 1960, Kidjo rose from the streets of West Africa to become one of the continent’s most powerful musical exports. Her signature albums like Logozo (1991), Black Ivory Soul (2002), Eve (2014), Celia (2019), and the Grammy-winning Mother Nature (2021), are said to have not only broken language and cultural barriers but reshaped how the world listens to African music. Kidjo’s musical collaborations span continents, from working with Carlos Santana, Alicia Keys, and Bono, to more recent cross-generational partnerships with Burna Boy, Yemi Alade, Davido, and Mr Eazi. In 2023, her duet with Davido, Na Money, became a continental hit, followed by Joy, a 2024 anthem championing African resilience and unity. Off-stage, Kidjo has dedicated her life to advocacy and education, especially for young African girls. As a UNICEF Goodwill Ambassador, she has been instrumental in campaigns promoting gender equality, access to education, and girls’ rights. She is also the founder of the Batonga Foundation, which provides secondary education and vocational training to adolescent girls in rural Benin and beyond. Her humanitarian efforts have earned her accolades from institutions, including the BBC, TIME Magazine, and Amnesty International. Reacting to the announcement, chairman of the Walk of Fame selection committee, Peter Roth said: “These talented individuals have made significant contributions to the world of entertainment, and we are thrilled to honour them with this well-deserved recognition.” Other honourees on the 2026 list include Bone Thugs-N-Harmony, Emily Blunt, Rami Malek, Josh Groban, and culinary icon Gordon Ramsay. NBA legend Shaquille O’Neal was the sole pick in the sports entertainment category.

Read more stories like this on punchng.com

profile/5170OIG3.jpeg.webp

Healthwatch

Wildfires: How To Cope When Smoke Affects Air Quality And Health

~3.5 mins read

Smoke from regional wildfires endangers health even for those not directly in the path of fire.

Create an evacuation plan for your family before a wildfire occurs.

Make sure that you have several days on hand of medications, water, and food that doesn’t need to be cooked. This will help if you need to leave suddenly due to a wildfire or another natural disaster.

Regularly check this fire and smoke map, which shows current wildfire conditions and has links to state advisories.

Follow alerts from local officials if you are in the region of an active fire.

Stay aware of air quality.AirNow.gov shares real-time air quality risk category for your area accompanied by activity guidance. When recommended, stay indoors, close doors, windows, and any outdoor air intake vents.

Consider buying an air purifier. This is also important even when there are no regional wildfires if you live in a building that is in poor condition. The EPA recommends avoiding air cleaners that generate ozone, which is also a pollutant.

Understand your HVAC system if you have one. The quality and cleanliness of your filters counts, so choose high-efficiency filters if possible, and replace these as needed. It’s also important to know if your system has outdoor air intake vents.

Avoid creating indoor pollution. That means no smoking, no vacuuming, and no burning of products like candles or incense. Avoid frying foods or using gas stoves, especially if your stove is not well ventilated.

Make a “clean room.” Choose a room with fewer doors and windows. Run an air purifier that is the appropriate size for this room, especially if you are not using central AC to keep cool.

Minimize outdoor time and wear a mask outside. Again, ensuring that you have several days of medications and food that doesn’t need to be cooked will help. If you must go outdoors, minimize time and level of activity. A well-fitted N95 or KN95 mask or P100 respirator can help keep you from breathing in small particles floating in smoky air.

As wildfires become more frequent due to climate change and drier conditions, more of us and more of our communities are at risk for harm. Here is information to help you prepare and protect yourself and your family.

How does wildfire smoke affect air quality?

Wildfire smoke contributes greatly to poor air quality. Just like pollution from burning coal, oil, and gas, wildfires create hazardous gases and tiny particles of varying sizes that are harmful to breathe. Wildfire smoke also contains other toxins that come from burning buildings and chemical storage.

Smoke carried by weather patterns and jet streams can cross state and national boundaries, traveling to distant regions.

How does wildfire smoke affect our health?

The small particles in wildfire smoke –– known as particulate matter, or PM10, PM2.5, PM0.1 –– are the most worrisome to our health. When we breathe them in, these particles can travel deep into the lungs and sometimes into the bloodstream.

The health effects of wildfire smoke include eye and skin irritation, coughing, wheezing, and difficulty breathing. Other possible serious health effects include heart failure, heart attacks, and strokes.

Who needs to be especially careful?

Those most at risk from wildfire smoke include children, older adults, outdoor workers, and anyone who is pregnant or who has heart or lung conditions.

If you have a chronic health condition, talk to your doctor about how the smoke might affect you. Find out what symptoms should prompt medical attention or adjustment of your medications. This is especially important if you have lung problems or heart problems.

What can you do to prepare for wildfire emergencies?

If you live in an area threatened by wildfires, or where heat and dry conditions make them more likely to occur:

What steps can you take to lower health risks during poor air quality days?

These six tips can help you stay healthy during wildfire smoke advisories and at other times when air quality is poor:

profile/5170OIG3.jpeg.webp

Healthwatch

Wildfires: How To Cope When Smoke Affects Air Quality And Health

~3.5 mins read

Smoke from regional wildfires endangers health even for those not directly in the path of fire.

Create an evacuation plan for your family before a wildfire occurs.

Make sure that you have several days on hand of medications, water, and food that doesn’t need to be cooked. This will help if you need to leave suddenly due to a wildfire or another natural disaster.

Regularly check this fire and smoke map, which shows current wildfire conditions and has links to state advisories.

Follow alerts from local officials if you are in the region of an active fire.

Stay aware of air quality.AirNow.gov shares real-time air quality risk category for your area accompanied by activity guidance. When recommended, stay indoors, close doors, windows, and any outdoor air intake vents.

Consider buying an air purifier. This is also important even when there are no regional wildfires if you live in a building that is in poor condition. The EPA recommends avoiding air cleaners that generate ozone, which is also a pollutant.

Understand your HVAC system if you have one. The quality and cleanliness of your filters counts, so choose high-efficiency filters if possible, and replace these as needed. It’s also important to know if your system has outdoor air intake vents.

Avoid creating indoor pollution. That means no smoking, no vacuuming, and no burning of products like candles or incense. Avoid frying foods or using gas stoves, especially if your stove is not well ventilated.

Make a “clean room.” Choose a room with fewer doors and windows. Run an air purifier that is the appropriate size for this room, especially if you are not using central AC to keep cool.

Minimize outdoor time and wear a mask outside. Again, ensuring that you have several days of medications and food that doesn’t need to be cooked will help. If you must go outdoors, minimize time and level of activity. A well-fitted N95 or KN95 mask or P100 respirator can help keep you from breathing in small particles floating in smoky air.

As wildfires become more frequent due to climate change and drier conditions, more of us and more of our communities are at risk for harm. Here is information to help you prepare and protect yourself and your family.

How does wildfire smoke affect air quality?

Wildfire smoke contributes greatly to poor air quality. Just like pollution from burning coal, oil, and gas, wildfires create hazardous gases and tiny particles of varying sizes that are harmful to breathe. Wildfire smoke also contains other toxins that come from burning buildings and chemical storage.

Smoke carried by weather patterns and jet streams can cross state and national boundaries, traveling to distant regions.

How does wildfire smoke affect our health?

The small particles in wildfire smoke –– known as particulate matter, or PM10, PM2.5, PM0.1 –– are the most worrisome to our health. When we breathe them in, these particles can travel deep into the lungs and sometimes into the bloodstream.

The health effects of wildfire smoke include eye and skin irritation, coughing, wheezing, and difficulty breathing. Other possible serious health effects include heart failure, heart attacks, and strokes.

Who needs to be especially careful?

Those most at risk from wildfire smoke include children, older adults, outdoor workers, and anyone who is pregnant or who has heart or lung conditions.

If you have a chronic health condition, talk to your doctor about how the smoke might affect you. Find out what symptoms should prompt medical attention or adjustment of your medications. This is especially important if you have lung problems or heart problems.

What can you do to prepare for wildfire emergencies?

If you live in an area threatened by wildfires, or where heat and dry conditions make them more likely to occur:

What steps can you take to lower health risks during poor air quality days?

These six tips can help you stay healthy during wildfire smoke advisories and at other times when air quality is poor:

Loading...

Gistlegit

Gistlegit

News_Naija

News_Naija

Healthwatch

Healthwatch