profile/9484image0.png.webp

Mark_

What Is Alta Equipment Group Inc.?

~1.5 mins read

“Alta Equipment Group Inc.” is a US company traded on the New York Stock Exchange under the ticker “ALTG” for its common stock and “ALTG PRA” for its preferred stock.

The company operates in the rental and leasing services industry. It has a dealership business model and sells, rents, and provides parts and service support for several categories of specialized equipment, including lift trucks and other material handling equipment, heavy and compact earthmoving equipment, crushing and screening equipment, environmental processing equipment, cranes and aerial work platforms, paving and asphalt equipment, other construction equipment, and allied products.

Alta Equipment Group Inc. currently operates in Michigan, the Midwest, New York, New England, Florida, Nevada, and the Canadian provinces of Ontario and Quebec. As of December 31, 2023, it had 85 stores. Since 2020, it has made 16 acquisitions aimed at territorial infill and expansion.

These acquisitions are reflected on the balance sheet of the company as goodwill (the excess purchase price of another company) and are increasing year over year.

The comany revenues come from five sources: new and used equipment sales, parts sales, service revenues, rental revenues, and rental equipment sales. Equipment sales make up approximately half of revenue, whereas rental revenues accounted for 10.78% of sales in 2023.

In addition to having physical stores and locations, Alta Equipment Group Inc. also provides services and showcases its product line through its website:

www.altg.com

According to MarketBeat, its competitors include the following companies:

DXP Enterprises (DXPE)

MRC Global (MRC)

Global Industrial (GIC)

Northwest Pipe (NWPX)

CompX International (CIX)

Hudson Technologies (HDSN)

Park-Ohio (PKOH)

Manitowoc (MTW)

GrafTech International (EAF)

Graham (GHM)

profile/9484image0.png.webp

Mark_

An Overview Of Custom Truck One Source, Inc.s Balance Sheet, 2024

~2.0 mins read

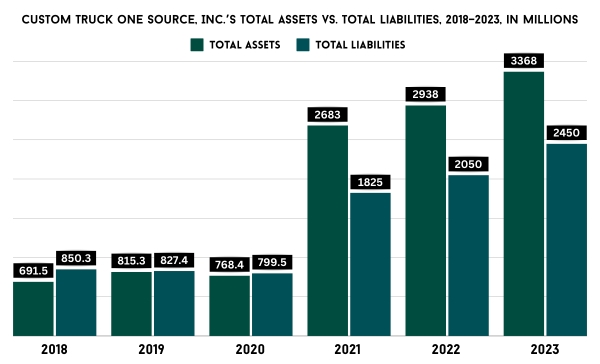

In this article, we’ll take a closer look at CustomTruck One Source, Inc.’s KPIs from the balance sheet, and the first one will be its cash for the past six years:

Its low cash reserves, likely acquired through debt, render it susceptible to unforeseen events and emergencies, but at the same time, the company’s growing accounts receivable make the financial situation more or less stable.

Its inventories are growing with revenue, which means the company manages to keep up with demand and is able to find ways to sell goods and increase revenue. However, the rising value of PP&E over the years tells us that the market is quite competitive and, compared to other industries, requires additional investments in order to succeed.

Since the beginning, Custom Truck One Source, Inc. has relied more on long-term debt than short-term debt, providing a layer of security against sudden increases in interest rates. However, as current liabilities slowly catch up to non-current liabilities, this layer of security may eventually disappear.

As you can see, Custom Truck One Source, Inc.’s debt-to-equity ratio was negative for some time because its shareholders’ equity was negative. Then it became positive, but slightly higher than the threshold of 2, which investors typically consider acceptable, and quite far from 0.80, which Warren Buffett and other investors would look for.

The company’s return on equity was uncalculable due to a period of negative shareholders’ equity, which could have resulted in an artificially positive ROE. Additionally, its return on assets at that time consistently remained negative, which is not surprising since the company has suffered losses for some years and only recently started to have positive net income. Overall, ROE and ROA performances do not appear appealing, but at least they are both positive now and increasing year over year.

Custom Truck One Source, Inc.’s current ratio history for the years 2018–2023

The company’s historical current ratio consistently exceeds 1, indicating a greater amount of current assets than current liabilities. This is advantageous for investors, as it enhances the stability of the company’s financial situation and enables it to safeguard itself during emergencies.

To sum up, the company’s balance sheet is somewhat okay, but it could have been better: the cash amounts are low, there are no retained earnings, efficiency KPIs such as ROE and ROA are poor, the DE ratio is greater than 2, etc. At least, we can rest assured that Custom Truck One Source, Inc. possesses a strong foundation and will not succumb to emergencies that easily.

Advertisement

Link socials

Matches

Loading...