Elina_elin

Business Person : Business Person : Cool And Easy Going ????

Wants to meet Business Partners : Interesting People With Good Vibes

Articles

175

Followers

36

profile/932320220914_214539.jpg

Elina_elin

END TIME!

~3.1 mins read

END TIME !!!!!😱😱😱😱

A FRIEND SHARED THIS WITH ME, PLEASE LADIES LET US BE CAREFUL WHAT GROUP WE ARE ADDED TO, ANISAGBAKOOOOO

👇👇👇👇👇👇👇👇

I was added to a secret watsapp group some months back.

This lady explained what d group stands for and I liked the idea.

It was about women supporting women..

And u all know it has been my mantra.

So I agreed to be added.

We were just 102 in d group and it was bubbling with activities...

If u miss opening the group for 1hr, u will be met with more than 200 unread messages.

I didn't have time to be going through chats all the time.

So at night before I sleep, I just read through...

A week after, I noticed a huge amount of money had been given as support to a lady who lost her husband to start her life.

I'm talking about 3.5M

I was pleased.

This is really 'women helping women' .

Not too long another member lost her husban.

Chai it was too much for the group.

2people almost same month...

3.5M was also donated..

My sisters..

Within 3months of my joining that group, 6ladies lost their husbands.

Then for like 3days,i didn't open the group bcos of time.

I have been very busy.

One evening, I decided to just read up before sleeping...

Omoh, there was chaos in d group.

A lady was complaining wen it will be her turn to benefit like other women as she was told before joining..

Another lady responded

"Wen u are ready to sacrifice ur husband, u get ur 3.5M

😳😳😳😳😳

Mogbe!!

Did I read well?

🙆♀️🙆♀️🙆♀️🙆♀️🙆♀️

Omoh, I had to chat the lady who hinted me about the group

.

" Madam, what's happening in d group"?

No response..

"What's this gist of sacrificing people's husbands"?

No response..

She read and ignored.

Then I changed strategy..

"Omoh, give me update oh!! No chop alone oh!! Mek i chop 3.5 M too na. Watever it is to get this money, I'm game"

She responded

" U mean am"?

I said "yes"

"U wey love ur GM pass ur life.. U fit?"

"I go fit if u explain"

Then she divulged

She said u must be a widow to benefit from the group. That it's a NGO that supports widows

So some desperate ladies who need the money by all means are doing the unimaginable

🙆♀️🙆♀️🙆♀️🙆♀️🙆♀️

😳😳😳😳😳

I doubt this though..

It seemed like a cult to me.

Cos dey have a slogan that dey use before saying anything in d group .

So for 3.5 M I will now miss my daily babzbzbzbzbsbssb

🙄🙄🙄🙄🙄😉

Truthfully, I don't have such amount..

Sincerely, I need money..

But I'm ready to hustle and make it.

Men, be careful oh!!

Things are happening in dis country...

Women are doing anything for the 'mula'

I left the group, blocked her on watsapp, on my contact list and on all social media platforms....

JUST BE CAREFUL...

From a Whatsapp group

profile/932320220914_214539.jpg

Elina_elin

Fidelity Bank Set To Acquire 100%Equity In Union Bank UK Plc.

~1.4 mins read

How Fidelity Bank is driving digital financial inclusion in Nigeria with impressive half year 2021 result

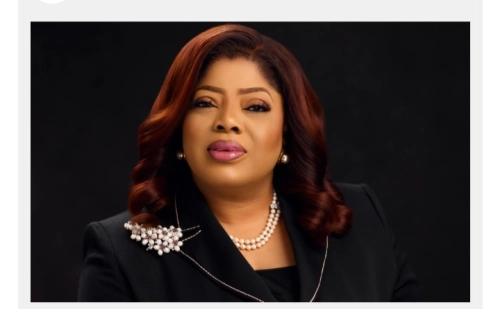

CEO of Fidelity Bank, Mrs. Nneka Onyeali-Ikpe

Fidelity Bank Plc has entered into a binding agreement to acquire 100% equity stake in Union Bank UK Plc.

According to a disclosure signed by Ezinwa Unuigboje, the Company Secretary on the proposed acquisition of 100% equity stake in Union Bank UK Plc by Fidelity Bank Plc, the transaction is subject to the approval of the Prudential Regulatory Authority of the United Kingdom.

Fidelity Bank said the development is in line with its expansion drive beyond the Nigerian market to enable it to deliver to its growing client.

What they are saying

Notifying the general public, Fidelity Bank Plc stated that it has entered into a binding agreement for the acquisition of 100% equity stake in Union Bank UK Plc for which the central bank has issued a letter of no objection.

It noted, “Union Bank UK commences operations from the heart of the city of London in 1983 to provide competitive banking services including personal banking, trades finance, treasury management and structured trade and community finance which offers to individual and corporate clients.”

Commenting on the agreement, Mrs Nneka Onyeali-Ikpe, the Managing Director/Chief Executive Officer, Fidelity Bank said, “This transaction aligns with our strategic plan of expanding our services touchpoints beyond the Nigerian market and providing straight-through services that meet and exceed the needs of our growing clients. The diverse bouquet and business model of union Bank UK offer a compelling synergy and we hope to build on the existing capacity to create a scalable and more sustaining service franchise that will support the wider ecosystem of our trade businesses and diaspora banking services.

The transaction is subject to the approval of the Prudential Regulatory Authority of the United Kingdom.

Advertisement

Link socials

Matches

Loading...