Garbamahmud4

Administrator : I Am An Administrator To The Core, Who Believe In The Values Of PODSCORB.

Wants to meet Career Partners : Anybody Who Believes In Administrative Ideas.

Articles

112

Followers

9

profile/2600FB_IMG_16041523560118425.jpg

Garbamahmud4

HOW TO TRANSFER YOUR RETIREMENT SAVINGS ACCOUNT (RSA)

~77.9 mins read

egg

to transfer your Retirement Savings Account (RSA)

PenCom has made available information that may help you if interested in transferring from one Pension Fund Administrator to another.

BUSINESS6 mins ago

Lagos designs eligibility form for businesses to access N1billion seed capital

COLUMNISTS11 mins ago

LDR Policy; Over one year after, where are we?

BUSINESS34 mins ago

PIB may be passed by first quarter of 2021 – Sylva

LIVE FEED39 mins ago

CWG Plc profits in 9M 2020 hit N463.5 million

CORONAVIRUS1 hour ago

COVID-19: 2 Corps members in Kano NYSC orientation camp test positive

ADVERTISEMENT

Copyright © 2020

ADVERTISEMENT

profile/2600FB_IMG_16041523560118425.jpg

Garbamahmud4

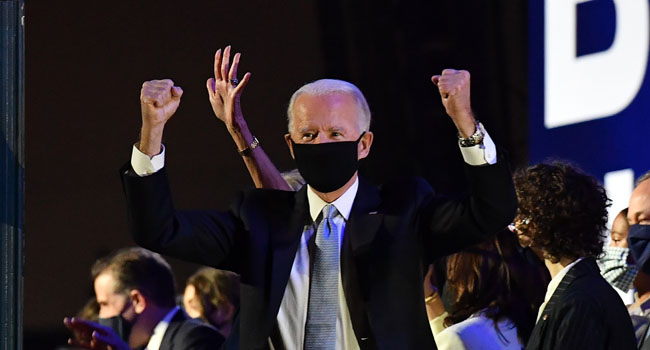

Biden Begins Transition As Trump Refuses To Concede Defeat.

~6.1 mins read

Biden Begins Transition As Trump Refuses To Concede Defeat.

US President-elect Joe Biden gestures in celebration after delivering remarks in Wilmington, Delaware, on November 7, 2020, after being declared the winners of the presidential election.

US President-elect Joe Biden gestures in celebration after delivering remarks in Wilmington, Delaware, on November 7, 2020, after being declared the winners of the presidential election. ANGELA WEISS / AFP

US President-elect Joe Biden took the first steps Sunday towards moving into the White House in 73 days, as Donald Trump again refused to admit defeat and tried to sow doubt about the election results.

With congratulations pouring in from world leaders and supporters nursing hangovers after a night of celebrations, Biden and Vice President-elect Kamala Harris announced they would receive a joint briefing Monday in Wilmington, Delaware from their transition Covid-19 advisory team.

Biden would then deliver remarks on coronavirus and economic recovery.

They also launched a transition website, BuildBackBetter.com, and a Twitter feed, @Transition46.

Meanwhile, Trump played golf at his course near Washington, the same place where he was Saturday when news broke that Biden had secured enough Electoral College votes for victory.

“Since when does the Lamestream Media call who our next president will be?†Trump complained in a tweet on Sunday.

Trump, who has no public events scheduled for Monday, plans to file a string of lawsuits in the coming week, according to his lawyer Rudy Giuliani, who said he had “a lot of evidence†of fraud.

But former president George W. Bush said the “outcome is clear†and added that he had called “President-elect†Biden and Harris to extend his congratulations.

Bush said in a statement that “the American people can have confidence that this election was fundamentally fair… We must come together for the sake of our families and neighbors, and for our nation and its future.â€

Biden’s transition website lists four priorities: Covid-19, economic recovery, racial equity and climate change.

“The team being assembled will meet these challenges on Day One,†it said in a reference to January 20, 2021, when Biden will be sworn in as the 46th president of the United States.

Biden, who turns 78 on November 20, is the oldest person ever elected to the White House. Harris, 56, a senator from California, is the first woman, first Black person and first South Asian person to be elected vice president.

Biden plans to name a task force on Monday to tackle the coronavirus pandemic, which has left more than 237,000 people dead in the United States and is surging across the country.

He has also announced plans to rejoin the Paris climate accord and will reportedly issue an executive order on his first day in office reversing Trump’s travel ban on mostly Muslim countries.

Biden has vowed to name a cabinet that reflects the diversity of the country, although he may have trouble gaining approval for more progressive appointees if Republicans retain control of the Senate — an outcome that will depend on two runoff races in Georgia in January.

– ‘Accept the inevitable’ –

Biden, who after John F. Kennedy is just the second Catholic to be elected US president, attended church Sunday morning in his hometown of Wilmington, Delaware.

He also visited the graves of his son, Beau Biden, who died of brain cancer in 2015, and his first wife and daughter, who died in a 1972 car accident.

The Trump campaign has mounted legal challenges to the results in several states, but no evidence has emerged of any widespread irregularities that would affect the results.

Giuliani told the Fox News show “Sunday Morning Futures†that Trump’s team would file a lawsuit in Pennsylvania on Monday against officials “for violating civil rights, for conducting an unfair election (and) for violating the law of the state.â€

“The first lawsuit will be Pennsylvania. The second will either be Michigan or Georgia. And over the course of the week, we should get it all pulled together,†Giuliani said.

First Lady Melania Trump also chipped in Sunday, tweeting: “The American people deserve fair elections. Every legal — not illegal — vote should be counted.â€

Speaking on CNN’s “State of the Union†Sunday, senior Biden advisor Symone Sanders dismissed the court challenges as “baseless legal strategies.â€

Biden received nearly 74.6 million votes to Trump’s 70.4 million nationwide and has a 279-214 lead in the Electoral College that determines the presidency.

Biden also leads in Arizona, which has 11 electoral votes, and Georgia, which has 16. If he wins both, he would finish with 306 electoral votes — the same total won by Trump in 2016 when he upset Hillary Clinton.

Only two Republican senators, Mitt Romney and Lisa Murkowski, have congratulated Biden.

Democratic Representative James Clyburn of South Carolina said the Republican Party has a “responsibility†to help convince Trump it is time to give up.

Romney, who voted to convict Trump at his impeachment trial, said the president will eventually “accept the inevitable.â€

The Utah senator added that he “would prefer to see the world watching a more graceful departure, but that’s just not in the nature of the man.â€

– ‘Do not concede, Mr. President’ –

Trump ally Senator Lindsey Graham of South Carolina said the 74-year-old president should keep fighting.

“We will work with Biden if he wins, but Trump has not lost,†Graham said on Fox News. “Do not concede, Mr. President. Fight hard.â€

In a victory speech on Saturday, Biden promised to unify the bitterly divided nation and reached out to Trump supporters, saying, “They’re not our enemies, they’re Americans.â€

“Let’s give each other a chance,†he said. “Let this grim era of demonization in America begin to end, here and now.â€

Financial markets welcomed Biden’s victory, with shares up in Tokyo and Hong Kong, and US futures up on Wall Street on Sunday evening.

The leaders of Britain, France, Germany, Italy, Spain and other European countries sent congratulations to Biden, along with Australia, Canada, India, Indonesia, Israel, Japan and South Korea.

Mexican President Andres Manuel Lopez Obrador said he would wait until all legal challenges are resolved, while Trump ally President Jair Bolsonaro of Brazil has yet to make any official comment.

-AFP

Advertisement

Link socials

Matches

Loading...