ReligionNews And PoliticsLifetipsRelationshipsNewsBusiness And MoneyHistoryComedyMotivationalsRelationship And MarriageCelebrityStoriesHealth And LifestylePoliticsMotivationEducationLawFamilySports And FitnessHealthCommunications And EntertainmentIT And Computer SciencePrinciplesAnimalsLifestyleScience And TechnologyNatureOthersKitchenMenPoemsGeneralAgricultureMarriageQuestions And AnswersQuestions AnsweredSocial SciencesSecuritySportsSpiritualityArtsVehicles And MobilityGive HelpHandiworksChildrenScience

Gale2626

Business Person : I'm A Town Planner By Qualification, Self Employed And A Blog Writer, Love Esthetics, Reading And Sports. And I'm Also Single In Case You Crush On Me, Just Say It...

Wants to meet A Spouse : Open To Meeting New Friends And Someone Special To Be With

Articles

396

Followers

60

Connect with me

profile/8055FB_IMG_15961823052589134.jpg

Gale2626

The Value Of Expertise

~0.7 mins read

A giant ship's engine broke down and no one could repair it, so they hired a Mechanical #Engineer with over 40 years of experience.

He inspected the engine very carefully, from top to bottom. After seeing everything, the engineer unloaded the bag and pulled out a small hammer.

He knocked something gently. Soon, the engine came to life again. The engine has been fixed!

7 days later the engineer mentioned that the total cost of repairing the giant ship was $10,000 to the ship owner.

"What?!" said the owner.

"You did almost nothing. Give us a detailed bill."

The answer is simple:

Tap with a hammer: $2

Know where to knock and how much to knock: $9,998

The importance of appreciating one's #expertise and #experience...coz those are the results of struggles, experiments and even tears.

If I do a job in 30 minutes it's because I spent 10 years learning how to do that in 30 minutes. You owe me for the years, not the minutes.

profile/8055FB_IMG_15961823052589134.jpg

Gale2626

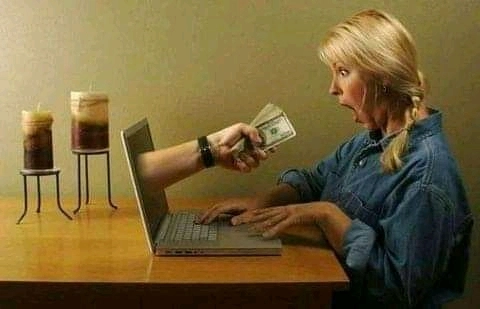

Earn Money Answering Questions Online

~17.6 mins read

These sites discussed here can fetch you good revenue as a Nigerian and as a non-Nigerian.So you wished get paid to answer questions online?These questions and answers websites have been around for a very longtime. Every day, millions of questions are answered online on sites like Quora, Askville and Yahoo Answers to mention but a few.Websites that pay to answer questionsIn fact, according to Comscore, Yahoo has over 200 million users, a big portion of which are users of its popular question & answer site, Yahoo Answers.For experts like you out there, this could mean a very good opportunity to earn money!If you’re knowledgeable about any specific topic, this is an easy way to make some extra cash in your spare time without having to spend a dime.Please note that these sites are different than trivia quiz apps where you can play trivia and win money.With paid answer sites you actually answer questions asked by users on many different topics from computer and tech to math, science and even DIY stuff.All you need is internet and a decent skill level in writing and you can earn money answering other people’s questions.So enough of the long details, can we talk the real deal?Here are a few sites that pay you for answering questions:WonderWonder is a website for people who need research done into specific questions.They do offer research into data, statistics, insights, and trends.When a customer asks a series of questions based on whatever they are researching, Wonder will compose a team of researchers to investigate each question.They have a 24-hour turnaround, making it great for getting fast and accurate results.So, how much can I earn?Each of the jobs has a set price, which you can see in advance of accepting any work.The length of time it takes to complete a job varies. However, most jobs are priced based on their difficulty.You can expect to spend 2-3 hours on each research job.Payment occurs every two weeks via PayPal.Researchers can earn up to $25 an hour, depending on how quickly they work and the type of job they take on.You might be asking….How do I join?WellWhen you apply, you will have to take a short quiz and complete a trial research assignment.After you are accepted, they will allow you to take on one job at a time.At Wonder, you can work whenever you want from anywhere in the world.Websites that pay to answer questionsThey do prefer researchers to answer at least one question a week. However, you will not be removed from the site for missing a week.Where to sign up: askwonder.com/researcherJust AnswersJust Answers is a site for people to seek advice from a variety of different kinds of experts. This allows customers to save money because Just Answers rates are a fraction of the cost of an in-person appointment.There are over 175 categories including lawyers, mechanics, doctors, and vets.There are over 11,000 verified experts on the website, and over 16,000,000 questions have been answered.How much can you earn?Top experts can earn over $1000 each month by helping customers.Of course, how much you earn depends on how much time you devote to the site.You can work whenever you want anywhere you want.All that’s required is a computer and internet connection.How do I join?In order to join as an expert, you must fill out an application which takes less than 30 minutes to fill out.You can apply to as many categories as you’d like but remember that you will be required to submit professional credentials for each category.The requirements vary for each category, but usually, the site will ask for work history, certification, and a diploma.Where to sign up: secure.justanswer.com/offer-services/landingExpert123Expert123 is a bit different than most other “answer questions” websites.At Expert123, you can write articles for their site and post them on your own blog. This allows authors to maintain credit for their work, which is unusual for most of these kinds of sites.Money is earned through their shared revenue program.Once you prove you are an expert in a specific field, the company will pay you to write articles for their clients.How much can I earn?The starting pay comes from ads.Expert123 pays with the money earned from ads on your article.The more questions you answer with articles, the more you advance to a paid writer spot within the company. The more traffic that shows up to that article, the more money you’ll earn.Once you become a paid writer, you earn between $10 to $20 for each article you write.You’ll also earn some ad revenue from those articles you write.Once you have earned $20, you can request a payout at any time.The company will send its funds through PayPal.How do I join?Anyone can join as long as they have some kind of expertise in a field. However, you also need to be able to write well enough to share your expertise with readers.To join, you will need to confirm your email with the company first. Then, they will have you set up a profile.Websites that pay to answer questionsYou can have up to 5 expertise categories on your profile, plus information about your interests, education, age, and location.Where to sign up: experts123.com/HelpOwlHelpOwl is a free resource which connects people to experts who can answer their questions.Not only are they are a Q&A site, but they also provide additional services such as product manuals, videos, and price comparison.How much can I earn?While all the services provided are free, there are still ways to be paid.HelpOwl works on a point system.Points can be traded for gift cards as an incentive for experts to answer questions.You can earn points for answering questions, marking answers helpful, reviewing a product or company, and submitting a manual.Points are actually quite easy to earn, unlike many other sites. Many actions on the site can earn you hundreds of points.In order to get a $10 gift card, you would need to answer 500 questions. However, these answers can be quite short, and each time someone marks an answer as helpful you will get points.How do I join?HelpOwl has the easiest signup process out of all these sites.All you need is to make an account and confirm your email address.After that, you can start answering as many questions as you want.You can apply by clicking the “Account” button at the top of their website.Where to sign up: helpowl.com/MavenIf you’ve ever been interested in becoming a consultant, you might love Maven.Maven is one of the highest rated online consulting companies. They deliver expertise to professionals in every industry.Maven works with huge companies such as Boeing, Intel, and Nestle.Their goal is to make customers smarter in a fast and easy way by connecting them with experts all over the world.How much can I earn?This depends on the industry you want to work at, as well as how many hours you want to put into the job.Thankfully, Maven has a calculator that will help you decide what to charge.Many consulting websites struggle to find clients for their experts.Thankfully, Maven does not have this problem. Because of their large clientele, consultants can usually find jobs quickly.Unlike most sites, you don’t have to watch for your perfect assignment. Maven will contact you when they find a potential match.Their jobs can be simple, such as answering questions by email. You can also take on more complex jobs which can involve consulting via telephone or participate in bigger projects.How do I join?Registering is easy.To join, all you need to do is set up an account, answer a few questions about your expertise, and set an hourly consulting rate.Where to sign up: maven.com/Wrapping upWhile there are many paid answer sites with some of which you can answer questions and win money.There are even trivia apps like SwagIQ where you can give answers and earn money.But when it comes to making real money from your expertise, I think these are the best sites to use.So if you are an expert on any topic, I would highly recommend you join some of these sitesSource: viralgist.co.uk/these-sites-pays-you-to-answer-questions/

Advertisement

Link socials

Matches

Loading...