Niceola2

IT Specialist : I'm An International Blogger Digital Daily Post Technology Global For Online News. I’ll Give You Recent And Happening News Reports And Gist As It Come All Over The World. [email protected]

Wants to meet Business Partners : I Like To Meet New People Online Business And Enlighten More Better About New Technologies.

Anne Klein 109168IVBN Round Dial Leather Strap Watch

4.5 out of 5 stars 514

$29.99 $29.99 + $20.52 shipping

Color: Brown

2 Used & New from $16.04

XOXO Women's XO5527 Clear Bracelet with Rhinestones on Gold Case Watch

NIXON Time Teller A045-100m Water Resistant Men's Analog Fashion Watch (37mm Watch Face, 19.5mm-18mm Stainless Steel Band)

Michael Kors Dylan Stainless Steel Chronograph Watch

4.6 out of 5 stars 1,493$153.16 $153.16 + $23.47 shipping

Color: Black/Rose gold

7 Used & New from $144.52

Michael Kors Women's Slim Runway Three-Hand Stainless Steel Quartz Watch

$145.00 $145.00 + $22.92 shipping

Color: Silver Sunray

7 Used & New from $99.95

Timex Unisex Weekender 38mm Watch

$33.42 $33.42 + $20.10 shipping

Color: Blue/Gray Stripe

11 Used & New from $29.90

4.5 out of 5 stars 10,478

$98.91 $98.91 + $22.04 shipping

Color: Black Stainless

17 Used & New from $70.43

Pappi Boss Haunt All Working Kid's Favourite LED Bands (Multicolour) Set of 6

Casio STR300-7 Sports Watch - White

$22.99 $22.99 + $20.75 shipping

Order it now. Offered by The Watch Box .

9 Used & New from $19.92

Timex Girls' My First Easy Reader Quartz Analog Synthetic Leather Strap, Pink, 12 Casual Watch (Model: T790819J)

OCOMMO iPhone 11 Pro Silicone Case, Full Body Shockproof Protective Liquid Silicone iPhone 11 Pro Case with Soft Microfiber Lining, Wireless Charging Pad Compatible, Sky Blue

Amazon Basics 6-Outlet Surge Protector Power Strip with 2 USB Ports - 1000 Joule, Black

$14.99 $14.99 + $24.81 shipping

Pattern Name: Power Strip Color : Black

2 Used & New from $13.19

Sunflower Plaid Raglan Sleeve T-Shirt Tee Womens Buffalo Plaid Shirts Round Neck Raglan Pullover Long Sleeve Tops

Sunflower Plaid Raglan Sleeve T-Shirt Tee Womens Buffalo Plaid Shirts Round Neck Raglan Pullover Long Sleeve Tops

Cherokee Women's Workwear Elastic Waist Cargo Scrubs Pant

$11.98 $11.98 + $28.87 shipping

Size: 3X-Large Plus Petite Color: Black

5 Used & New from $11.98

Wrangler Women's Western Yoke Two Pocket Snap Shirt

$32.11 $32.11 + $24.93 shipping

Size: Medium Color: White

2 Used & New from $31.87

Wrangler Women's Western Yoke Two Pocket Snap Shirt

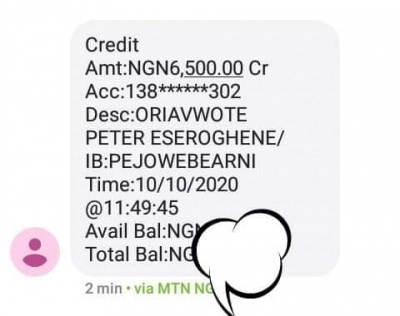

After you must have posted your content/write up or others on Pejoweb, Your Earning grows by the Numbers of views/ likes you get on your post. It normally ranges from 25, 50 to 100 cent (see Pejoweb terms and policy) depending on how Genuine and original your content is and little bit lengthy write up also attract more Earnings.

To register Click here

You can reach me via call or WhatsApp on https://wa.me/2348088748634

For further details, you can also send me direct message.

Note: For you to earn faster on Pejoweb, make sure you send your page link to other social medias, and to family and friends to benefit From your knowledge.

Advertisement

Link socials

Matches