profile/5691Screenshot_20210214-083307.png.webp

Benitoprofits081

Forex Trading Makes Life Easy

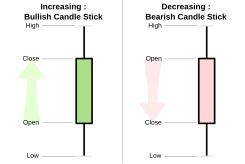

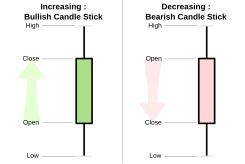

The area between the open and the close is called the real body, price excursions above and below the real body are shadows (also called wicks). Wicks illustrate the highest and lowest traded prices of an asset during the time interval represented. The body illustrates the opening and closing trades.The price range is the distance between the top of the upper shadow and the bottom of the lower shadow moved through during the time frame of the candlestick.The range is calculated by subtracting the low price from the high price.If the asset closed higher than it opened, the body is hollow or unfilled, with the opening price at the bottom of the body and the closing price at the top. If the asset closed lower than it opened, the body is solid or filled, with the opening price at the top and the closing price at the bottom. Thus, the color of the candle represents the price movement relative to the prior period's close and the "fill" (solid or hollow) of the candle represents the price direction of the period in isolation (solid for a higher open and lower close; hollow for a lower open and a higher close). A black (or red) candle represents a price action with a lower closing price than the prior candle's close. A white (or green) candle represents a higher closing price than the prior candle's close. In practice, any color can be assigned to rising or falling price candles. A candlestick need not have either a body or a wick. Generally, the longer the body of the candle, the more intense the trading.[5]

In trading, the trend of the candlestick chart is critical and often shown with colors.

profile/5691Screenshot_20210214-083307.png.webp

Benitoprofits081

About Vix 75

The volatility of 75 indexes is usually abbreviated as VIX and indicates the volatility of one of the most closely monitored stock indices, the S&P 500. VIX is an indicator of the market’s fear, and when it exceeds 30, the market is in fear mode. The level of fear is directly proportional to the VIX value. If the VIX is less than 30, it indicates complacency. The VIX is ideal for traders who wish to profit from volatile markets or hedge in the short term.

Volatility Index or VIX or volatility 75 is a special CBOE (Chicago Board Options Exchange) index created to measure the volatility of the S&P500 index. VIX Index projects the probable range of movement in the U.S. equity markets, above and below their current level, in the immediate future, usually next 30 days. This volatility index is often known as the “fear index.†