Health And LifestyleNews And PoliticsBusiness And MoneyCommunications And EntertainmentSports And FitnessArts And EducationOthersRelationship And MarriageGive AidScience And TechnologyLawFood And KitchenReligion And PrinciplesPersonal Care And BeautyIT And Computer ScienceEngineeringFamily And HolidaysMotivationals

Sgpeterson

Wants to meet Business Partners : I Need People Who Are Interested To Learn How To Earn Extra Money From VTU Top Up Printing Of Recharge Card Etc

Articles

311

Followers

10

profile/842FB_IMG_159728677531714411.jpg

Sgpeterson

BITCOINS SURGS AFTER PAYPAL JUMPS INTO CRYPTOCURRENCY BUSINESS

~2.2 mins read

New York (CNN Business)PayPal is launching its own cryptocurrency service, allowing people to buy, hold and sell digital currency on its site and applications.

The online payments company declared adding crypto was a significant milestone on the path to mainstream adoption of cryptocurrencies such as bitcoin. Bitcoin investors agreed: Prices rose 5% on the news Wednesday.

The efficiency, speed and resilience of cryptocurrencies give people financial inclusion and access advantages, said PayPal President and CEO Dan Schulman, who described the eventual shift from physical to digital currencies as "inevitable."

Cryptocurrency is digital money exchanged without fees between two parties online with no involvement from traditional banks and no regulatory oversight by national governments.

"Our global reach, digital payments expertise, two-sided network, and rigorous security and compliance controls provide us with the opportunity, and the responsibility, to help facilitate the understanding, redemption and interoperability of these new instruments of exchange," Schulman said in a statement. "

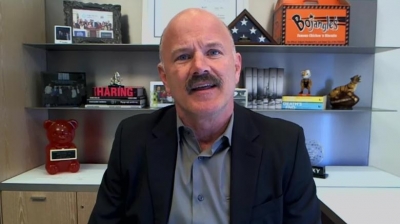

Paypal CEO Dan Schulman delivers his keynote conference during the Mobile World Congress at the Fira Gran Via complex in Barcelona, Spain on February 22, 2016.

profile/842FB_IMG_159728677531714411.jpg

Sgpeterson

#ENDSARS: LCCI POSTPONES 2020 LAGOS TRADE FAIR

~2.2 mins read

Trade Fair

ON OCTOBER 30, 20202:09 AMIN ECONOMY

ECONOMY

By Yinka Kolawale

As a fallout of the crisis precipitated by the #EndSARS protests, the Lagos Chamber of Commerce and Industry (LCCI) has announced the postponement of the 2020 edition of the Lagos International Trade Fair.

According to the Chamber, the fair which will feature both physical (In-person) and virtual (Online) platforms, is now scheduled to hold from Friday 4th to Sunday 13th December, 2020, noting that the shift is occasioned by the economic disruptions brought about by the COVID-19 pandemic and the recent EndSARS protests across the nation.

The Trade Fair is scheduled to run for a total of ten (10) days at the Tafawa Balewa Square (TBS) in Lagos.

READ ALSO:NCC remits N344.71bn to Consolidated Revenue Fund

In a statement, Director General, LCCI, Muda Yusuf said: “The resolve to hold the 2020 edition of the fair is in line with the need for quick restoration of normalcy in the economic and commercial activities in Lagos State and our support for the ongoing “Protect Lagos†Campaign, which is geared towards rebuilding the Centre of Excellence. In addition to the General Interest Fair, the annual international business expo will also feature Special days for corporate organisations to showcase their inventions, innovations, and sustainability initiatives simultaneously with the fair. The focus, this year, is to facilitate trade and chart a way forward for the economy to exit the impending recession.â€

Advertisement

Link socials

Matches

Loading...