Aspiring To Own One Of The World’s Biggest Business Empire They Say Is Aiming Too High, But A Lot Of

profile/9287BeautyPlus_20200621130347_save.jpg

Mrkings

Bitcoin Lord

~59.4 mins read

By Onaolapo olalekan oduola

Aspiring to own one of the world’s biggest business empire they say is aiming too high, but a lot of people own several businesses and companies doing excellently great, one can only work hard, stay focused and determined to achieve set goals.

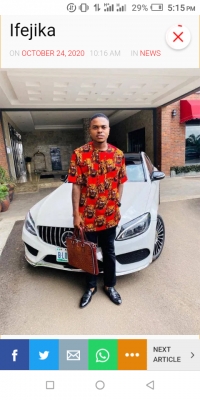

Linus Williams Ifejika is an avid businessman who runs the world of crypto currency through his business B-lord Group of Company.

The young man who hails from Ebenebe , Awka north, Anambra state Nigeria, and was born on the 14th of March 1998, facilitated his academic learning at St Gokate High school obiaruku delta state, and proceeded with tertiary education, then bagged a brilliant results in Businesses Administration at Anambra state university Uli, and looks forward to broadening his horizon by having series of qualifications in his name.

Coming from a nation where a 9-5 job is only for the strong willed, and barely meets the needs of an average Nigerian, he created a job for himself and others.

Linus Williams ifejika fine tunes why his businesses sets out to be what it is already, and molded the data from the designed online financial trading systems and platforms.

The vibrant goal driven, skilled and ardent entrepreneur is business driven and gets his inspiration to add to the Nigerian economy through the toughness of the society. He saw the need to start a crypto currency business because that is what the young men in the society ventures into and it is such a great way to be profitable.

READ ALSO: EndSARS protests: Methodist Bishop sues for peace

Looking at how things played out, in every situation, he sees happiness as a way of defeating negativity, and he is passionate about happiness and loves to stay indoor, but with friends around, thinking and strategizing on how to make the most of available resources and time.

Linus Williams Ifejika aims to build, and own one of the largest and biggest bitcoin bank in the world which would be known for transparency, reliability, competence, and also use that medium to serve as a consultancy institution regarding crypto currency that would as well train youngsters who are interested in the field. And also sensitize people with little or no idea about crypto currency and those who had bad experience in the field would pass through an evaluation process.

He sees Tony Elumelu as his mentor in the business field, and he is working relentlessly to see he achieves that.

All rights reserved. This material and any other digital content on this platform may not be reproduced, published, broadcast, written or distributed in full or in part, without written permission from VANGUARD NEWS.

NWAFOR

profile/9287BeautyPlus_20200621130347_save.jpg

Mrkings

MTN Shareholder

~51.4 mins read

Related

MTN Nigeria records gain, investors profit up by N42 billionSeptember 22, 2020In "Stock Market"

Dark Clouds loom for investors as stocks fall 8% in first half of 2020July 2, 2020In "Spotlight Stories"

LASACO Assurance Plc Chairman, Aderinola Disu resigns from the Board of Directors

Aderinola Disu resigned her position as a Director on the Board of LASACO Assurance.

The following information is contained in a press release made available to the public, signed by the company Secretary, Gertrude Olutekunbi, and verified by Nairametrics.

The notification also revealed that, the aforementioned firm has received a provisional approval from the National Insurance Commission (NAICOM) to appoint two other directors.

The two newly appointed directors are; Dr (Mrs.) Maria Olateju Phillips, and Prince Jamiu Adio Saka, both appointed to a Non-Executive Director role.

MTN: Data subscriptions triggered surge in Q2 2020 Revenues

Data revenues jumped from N56.7 billion to N79.9 billion in the period under review.

Dangote Sugar lists additional ordinary shares on NSE

This arose from the Scheme of Merger between Dangote Sugar Refinery Plc and Savannah Sugar Company Limited (SSCL).

This disclosure signed by Head, Listings Regulation Department, Godstime Iwenekhai, was released during trading hours on Wednesday.

In line with the resolution passed at the Court-Ordered meeting of members of Dangote Sugar Refinery Plc on the 9th of July 2020, the additional shares listed on the Exchange arose from the Scheme of Merger between Dangote Sugar Refinery Plc and Savannah Sugar Company Limited (SSCL).

The additional 146,878,241 ordinary shares of 50 kobo listed are in consideration for the transfer by SSCL of all its assets, liabilities and business undertakings, including real property and intellectual property rights to DSR.

Hence, these shares shall be issued and allotted to the shareholders of SSCL (The Scheme Shareholders), in place of 162,756,968 ordinary shares held by the Scheme Shareholders in SSCL as at close of business on the terminal Date, when Dangote Sugar merged with Savannah Sugar Company Limited.

ADVERTISEMENT

COMPANIES2 hours ago

MTN shareholders have made approximately N1 trillion since April 2020

MARKET VIEWS3 hours ago

TOTAL, GTBank lead Nigeria Stocks up, investors gain a whopping N350 billion W/W

CRYPTOCURRENCY5 hours ago

Crypto robber behind over $200 million theft, found

BUSINESS5 hours ago

HealthPlus: Is Leo Stan Ekeh really behind the takeover?

PERSONAL FINANCE5 hours ago

The top 3 essentials for financial success in the 21st century

ADVERTISEMENT

Copyright © 2020

Advertisement

Link socials

Matches

Loading...