Select a category

Advertisement

APC chieftain Joe Igbokwe in response to Davido’s recent comments about the Nigerian economy has said Davido should retract his statement as soon as possible. Nigeria made him.

He said his in-law Davido has made him sad by telling the world in America that Nigeria’s economy is in sh@mbles. This is very sad. He will advise him to retract the statement as soon as possible because Nigeria made Davido.

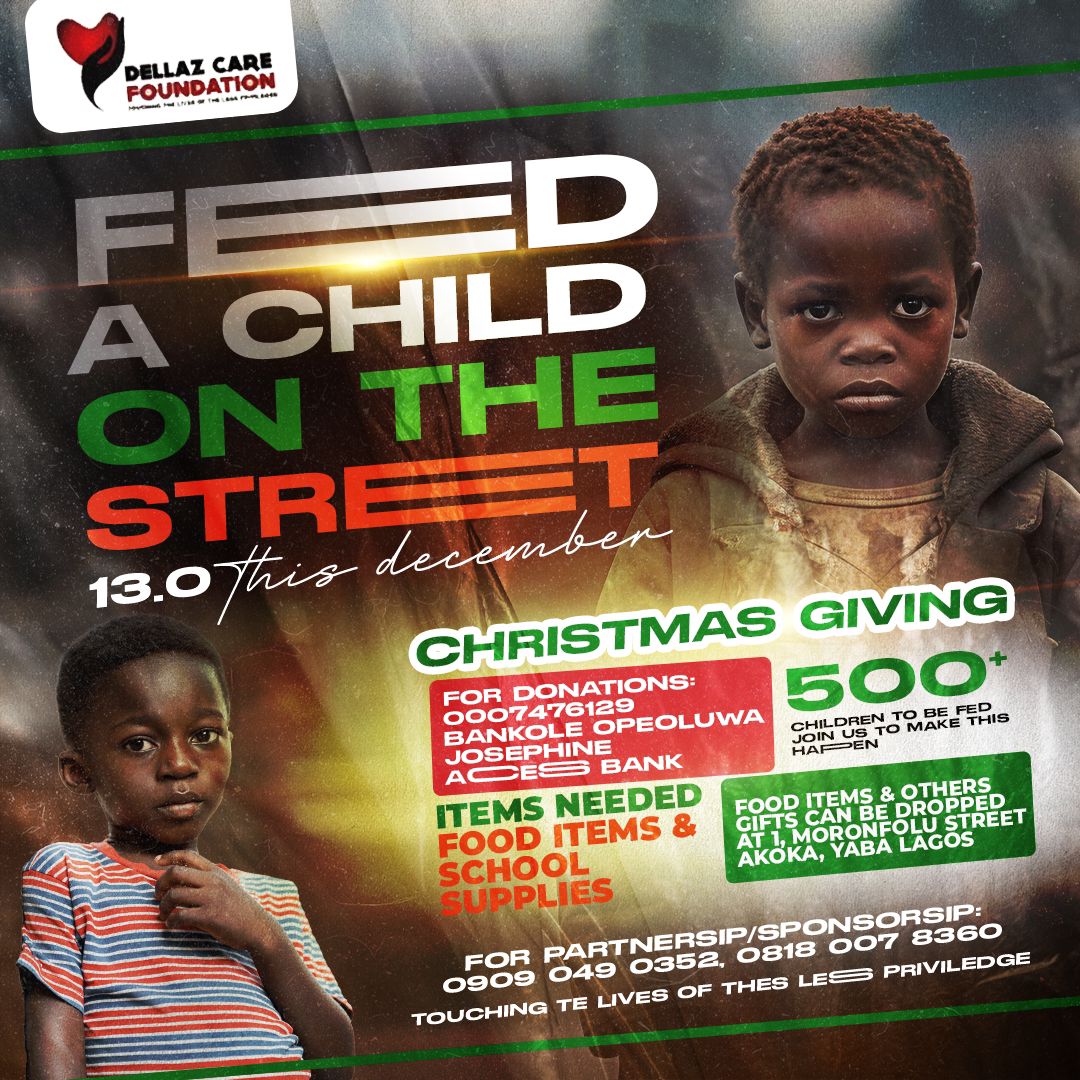

DellazCare Foundation to Visit Makoko Community for 3rd Edition of Outreach Program

During a press conference held in Lagos, DellazCare Foundation's founder, Miss Opeoluwa Josephine Bankole, reaffirmed the organization's commitment to addressing hunger and assisting underserved communities. The foundation's primary goal is to bring nourishment, joy, and hope through its impactful programs.

Advertisement

Actress Carolyna Hutchings has said times are hard now but all will be well as she pens kind words to Pres. Tinubu.

She said she knew the president is trying his best to better the lot of the nation and he is doing it with some of his ministers, governors and commissioners. She prays for grace and God’s protection with guidance . She also prays that all his good intentions will come to pass.

Although the times are hard, she prays and believes that by the end of his tenure everything we end is praise and success for all.

Concerns has mounted as a skitmaker has drownn in Lagos lagoon during a skit shoot.

The skitmaker drown in the process of skitnaking which makes it a second case of drowning in three days. It’s now beginning to look like at least a person drowns in the lagoons of Lagos on a daily basis.

Igirigi Ego was allegedly arrested by Chinese police over finance related charges.

He was arrested after a video he did flaunting money.

Click to watch

Advertisement

Reno Omokri has said you may have US citizenship, but that doesn’t mean you should de-market Nigeria, as he criticized Davido for advising Americans against relocating to Nigeria, citing Wizkid’s record-breaking streams as proof of the country’s potential despite economic challenges.

He beg to disagree with singer Davido that Nigeria’s ‘economy is in shambles’. If our economy is in shambles, how was it possible for Wizkid’s album, Morayo, to record 12.12 million streams on its inaugural day of release on Spotify Nigeria, which made the album the biggest-selling album on a streaming platform in Nigeria’s history for the first day.

Please fact-check me: Streaming music is purchased with disposable income. People do not have disposable income in an economy in shambles, not to mention breaking streaming records, especially on Spotify, where the average streaming cost is $10.99 monthly.

How many singers have broken streaming records in Venezuela or Argentina? Those are economies that could be said to be in shambles, not Nigeria.

Perhaps if Davido had built a track record of showing more commitment to Nigeria, he, like Wizkid, would have broken streaming records on Spotify Nigeria.

He urge Davido to learn from Rihanna, who never talks down on her country and instead uses her celebrity to promote Barbados and project her positively to the world. Which is why Rihanna was named a national hero and cultural ambassador for Barbados in 2018. David Adeleke displayed ignorance and a lack of patriotism with that statement on a globally renowned podcast like The Big Homies House. Even worse is that he said “We do not have the best leader, that is a fact.”

It is rather disappointing for a young man whose uncle is a governor and should, therefore, know better. Even worse, he said that to a foreign audience in a foreign country. Davido may have US citizenship, but that does not mean he should de-market Nigeria.

The reforms in Nigeria were necessary to stop wastage, such as the $1.5 billion used to defend the Naira monthly, the $15 billion expended on fuel subsidy annually, and the wanton importation of products that we could manufacture in Nigeria by opportunistic importers.

And the reforms are working. Nigeria has had four uninterrupted consecutive quarters of trade surpluses for the first time ever, meaning that we now export more than we import. Nigeria has achieved a new record in its balance of trade, with an unprecedented N14.07 trillion trade surplus by half year 2024.

On Thursday, March 28, 2024, the Nigerian Stock Exchange crossed 104,562.06 All Shares Index, a 39.84% increase year-to-date, making it the second-best performing exchange in Africa. The reforms have come with some short-term challenges, which are understandable.

Nevertheless, steps have been taken to cushion their effect on Nigerians and raise their purchasing power, including the increase of the minimum wage by 140% from #30,000 to #70,000, which is probably why our youths had the power to help Wizkid break streaming records.

Student loans have also been introduced for both students of federal and state-owned tertiary institutions for the first time in Nigeria’s history, even as conditional cash transfers have been paid and are still being paid to the poorest of the poor in Nigeria.

And it may be that his personal experience in Osun State has made Davido take such a position. After all, Osun State, under the dancing Governor, Senator Ademola Adeleke, was one of the last states to increase their minimum wage to match up with the Federal Government’s new minimum wage, despite receiving 65% more federal allocation under the Tinubu government.

If that is the case, then Davido may want to specify that Osun’s local economy is in shambles, not Nigeria’s.

Instablog9ja

Instablog9ja Gistlegit

Gistlegit