Select a category

:max_bytes(150000):strip_icc()/GettyImages-21503179901-0707da00b1154981a22d910cb511fca7.jpg)

The saga for control of Paramount Global (PARA) continues, with Skydance Media reportedly demanding that the entertainment giant stop negotiating with Edgar Bronfman Jr.

Skydance, in a letter from its lawyers, said Paramount's special committee breached the terms of its takeover agreement for Shari Redstone's media empire by extending the "go-shop" deadline to Sept. 5, according to .

Paramount on Wednesday extended the deadline to assess bids rivaling Skydance's after receiving Bronfman's reported $6 billion offer for Redstone's National Amusements and a minority stake in the entertainment giant.

Skydance said Bronfman's bid for control of Paramount isn't superior and therefore the deadline shouldn't have been extended, the reported.

David Ellison's company had agreed to a deal with Redstone worth more than $8 billion that involved buying National Amusements and merging Skydance with Paramount, the reported last month.

Bronfman's offer is the latest in a series of bids for control of Paramount in recent months. The entertainment firm, which owns CBS, MTV, and its eponymous movie studio, has been struggling as the rise of streamers like Netflix (NFLX) disrupt traditional networks.

Paramount shares are slipping 1.6% about 45 minutes before the opening bell Friday. They have lost about a quarter of their value year-to-date.

Do you have a news tip for Investopedia reporters? Please email us at [email protected]Read more on Investopedia

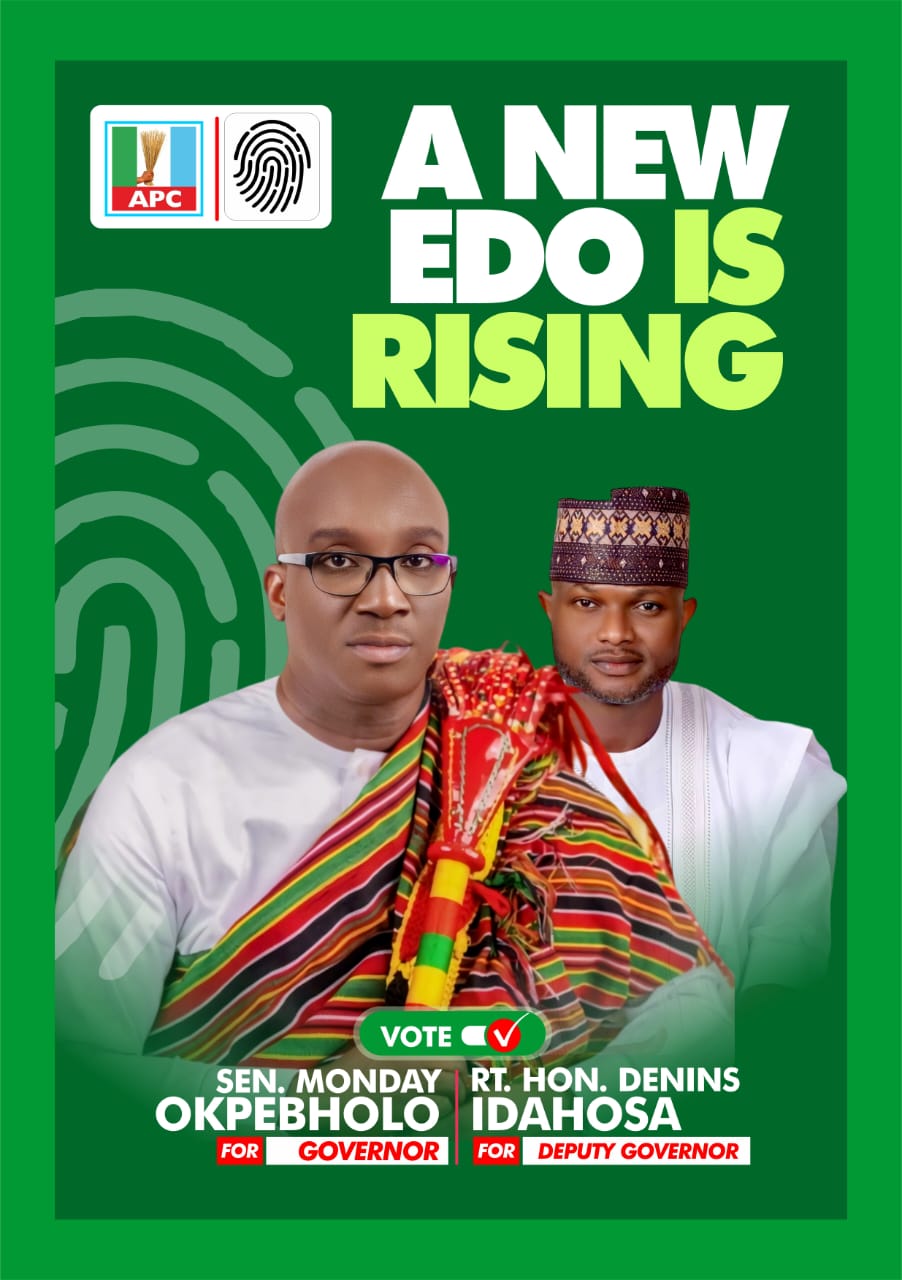

Oshiomhole Calls Out Bloodthirsty Opposition at Egor Rally, Demands Justice for Fallen Police Inspector

A recently married man has sparked controversy after some of his old comments about women were dug up by some netizens.

Several of his comments appeared to be antagonistic towards women, which left many wondering what type of husband he would be towards his wife.

:max_bytes(150000):strip_icc()/GettyImages-2167185037-529373ee190d49b8b910ef09d9d8fd11.jpg)

Federal Reserve chair Jerome Powell will make a highly anticipated speech this morning in Jackson Hole, Wyoming, with investors closely watching to see what he says about potential interest-rate cuts; Canada orders an end to the lockout by the country's two big rail operators; Skydance Media reportedly seeks an end to Edgar Bronfman Jr.'s bid for Paramount Global (PARA); Workday (WDAY) shares are jumping in premarket trading after the human resources software provider posted quarterly results that beat estimates; and Nestlé (NSRGY) stock is falling in Swiss trading after the chocolate maker replaced Chief Executive Officer (CEO) Mark Schneider amid sluggish sales. U.S. stock futures are rising ahead of Powell's speech as indexes to end the week higher despite yesterday's drop. Here's what investors need to know today.

Investors will be closely watching the speech this morning by Federal Reserve chair Jerome Powell at the annual Jackson Hole symposium for signals that the Fed is on course to cut its benchmark interest rate from a 23-year high when policymakers next meet in September. The minutes from the Fed's July policy meeting on Wednesday showed increasing support for a rate cut at the policy committee's next meeting, and investors will be looking for signals from Powell on both the pace and the magnitude of cuts this year. While the Fed's high interest rates have helped bring inflation closer to its annual target rate of 2%, recent data that showed the July unemployment rate jumped to 4.3% have sparked policymakers' concerns about the strength of the labor market.

One of Canada's two biggest freight railroad operators ended its lockout of unionized workers while the other prepared to resume operations after Ottawa ordered an end to their stoppages, which threatened trade with the U.S. and the national economy. Canadian National Railway (CNI) said it ended its employee lockout effective at 6 p.m. ET Thursday, while Canadian Pacific Kansas City (CP) said it is "preparing to restart railway operations." The two had locked out nearly 10,000 workers just after midnight Thursday after unsuccessful negotiations with the Teamsters Canada union. The Canadian government ordered the end to the lockouts after less than a day, and said an arbitrator would negotiate between the rail operators and the union.

The saga for control of Paramount Global (PARA) continues, with Skydance Media reportedly demanding that the entertainment giant stop negotiating with Edgar Bronfman Jr. Skydance, in a letter from its lawyers, said Paramount's special committee breached the terms of its takeover agreement for Shari Redstone's media empire by extending the "go-shop" deadline to Sept. 5, according to . Paramount on Wednesday extended the deadline to assess bids rivaling Skydance's after receiving Bronfman's reported $6 billion offer for Redstone's National Amusements and a minority stake in the entertainment giant. Skydance said Bronfman's bid isn't superior and therefore the deadline shouldn't have been extended, the reported. Paramount shares are slipping more than 1% in premarket trading.

Workday (WDAY) shares are soaring more than 12% in premarket trading after the human resources and capital management software provider reported better-than-estimated quarterly results and pointed to growth opportunities in international markets. The company's stock, which is down around 25% from its record close through Thursday, has come under investor scrutiny this year over concerns that enterprise customers have trimmed spending on premium software subscription services amid macroeconomic uncertainty.

Nestlé SA (NSRGY) shares are falling 2% in Swiss trading after the chocolate maker replaced Chief Executive Officer (CEO) Mark Schneider amid slowing sales. Schneider, who also is resigning from the board, will be replaced on Sept. 1 by veteran company executive Laurent Freixe, who heads its Latin American operations. During his eight years with Nestle, Schneider focused the Swiss firm "on high-growth categories like coffee, pet care and nutritional health products," the company said. But Nestle shares have fallen 10% this year amid declining sales as increasingly frugal consumers watch their spending.

Do you have a news tip for Investopedia reporters? Please email us at [email protected]Read more on Investopedia

Many investment options exist for a Roth IRA, a tax-advantaged individual retirement account. Most investors saving for retirement and looking to build a long-term, buy-and-hold portfolio may choose a mix of stocks and bonds.

The precise mix of stocks and bonds depends on two primary factors: how far the investor is from retirement and how risk-averse they are. The further an investor is from retirement, the more volatility they tolerate, and hold more stocks in their portfolio. Investors with a low-risk tolerance may not be able to handle swings in the value of their portfolio and decide bonds will be a large proportion of their portfolio.

Traditional investing wisdom has claimed that a 60/40 portfolio—60% stocks and 40% bonds—will satisfy the needs of most investors and that the proportion of stocks relative to bonds should shrink as the investor ages. Another traditional yardstick for investors has been “100 minus your age” relative to stock investment. A 30-year-old, for example, should hold 70% stocks and 30% bonds.

Some financial advisors recommend that holding a higher percentage of stocks throughout an investor’s career can greatly enhance potential returns while only marginally increasing the risks. In 2023, model portfolios were utilized given an inflationary unstable economic climate. Model portfolios add exposure to more asset classes including commodities, foreign currencies, real estate, quant strategies, and alternative investments.

Three mutual funds for Roth IRAs carry a Morningstar Gold rating in 2024. Contribution limits for IRAs, whether Roth or traditional, are $7,000 under age 50 or $8,000 for ages 50 and over in 2024. The Roth IRA contribution limit and eligibility to contribute depend on an individual's income level.

As of Dec. 5, 2023, VDIGX holds 42 stocks across several sectors including healthcare, technology, and consumer staples. The fund focuses on top companies such as Microsoft and Northrup Grumman Corp. that can grow their dividends over time. One of the fund’s risks is that returns from dividend-paying stocks may trail returns from the overall stock market during any given period.

DODFX holds a portfolio of equity securities issued by medium-to-large, non-U.S. companies that have a favorable outlook for long-term growth according to Morningstar. As of Dec. 5, 2023, the fund's holdings of 69 companies include Sanofi and Novartis.

As of Dec. 5, 2023, FPACX holdings include a mix of bonds, stocks, and cash equivalents. Its portfolio holds U.S. government bonds as well as shares of Comcast and Alphabet. According to the fund objective, FPACX hopes to generate equity-like returns over the long term by incurring less risk than the market.

Consistent with modern portfolio theory, risk-averse investors will find that including investments in an equity fund, a bond fund, and an international stock index fund provides a degree of diversification.

Investors can choose exchange-traded funds (ETFs) or index-focused ETFs for IRA investment. Index funds mimic the performance of an index by passively investing in the securities included in the index.

Yes. There is no limit to the number of Roth IRAs that an individual can have. However, increasing the number of Roth IRAs does not increase the amount that one can contribute each year.

Most investors saving for retirement through a Roth IRA will want some combination of stocks and bonds. This combination can be achieved by investing in a broad stock index fund, a broad bond fund, and perhaps an international stock fund.

Do you have a news tip for Investopedia reporters? Please email us at [email protected]Read more on Investopedia

:max_bytes(150000):strip_icc()/GettyImages-1398864442-88b6949064954bc4b3a137a6f1c867b6.jpg)

Zoom Video Communications (ZM) shares popped Thursday after the provider of remote video services reported better-than-expected results and provided a rosy outlook as it held on to more customers.

The company posted fiscal 2025 second-quarter adjusted earnings per share (EPS) of $1.39, with revenue increasing 2.1% to $1.16 billion. Both exceeded estimates.

Enterprise revenue grew 3.5% to $682.8 million, while online revenue was flat at $479.7 million. However, the average monthly “churn rate” of online customers dropped 30 basis points (bps) to 2.9%, That was "its lowest ever rate,” Zoom Founder and Chief Executive Officer (CEO) Eric Yuan said.

Zoom said that it had 3,933 customers contributing more than $100,000 in trailing 12 months revenue, a gain of about 7.1% year-over-year. Yuan said the company was able to sell high-end packages by offering advanced artificial intelligence (AI).

Zoom said it sees full-year adjusted EPS at $5.29 to $5.32 and revenue between $4.63 billion and $4.64 billion. Both are above analysts' expectations.

The company also announced the departure of Chief Financial Officer Kelly Steckelberg.

Steckelberg, who has been with Zoom for seven years, told analysts that she would be staying on through the current quarter earnings report. Yuan said that the company “is conducting a comprehensive search” for her replacement.

Zoom shares finished 13% higher at $68.04, their highest level since March. The stock is still a far cry from its October 2020 all-time highs above $500.

Do you have a news tip for Investopedia reporters? Please email us at [email protected]Read more on Investopedia

Investopedia

Investopedia Gistlegit

Gistlegit Instablog9ja

Instablog9ja